Trust Nods - The Human BlockDAG

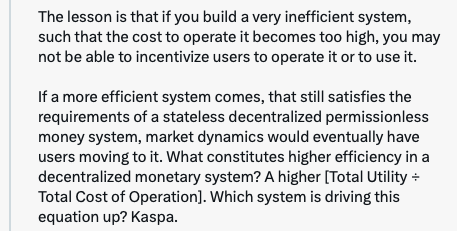

BlockDAG over blockchain. Blockchain is just another type of chain.

Click here to see the latest posts.

Freedom Trumps All

Launched on July 4th, 2018.

Crypto is the new real estate you can carry around in your pocket.

Gifs Provided by Giphy

Owning Bitcoin is more socially efficient than owning a wagon full of

Owning and using Kaspa is more socially efficient than owning and using

Why isn’t Google.com a Brave Verified Publisher?

Value and limited supply are related.

If you work for paper money you are going to be disappointed.

Any money that can be printed will eventually end up worth less.

When people find out that printed money is given in many circumstances without being earned or backed by value they will wonder why they even worked for printed money in the first place. They will demand a hardcapped amount, uncontrolled, secure, and non-reproducible store of value.

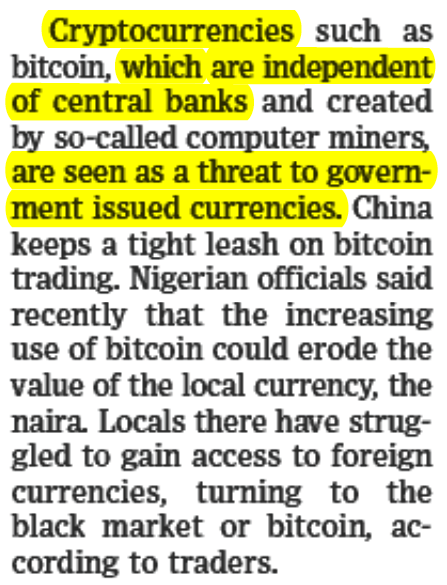

Banning bitcoin would be like banning electricity. You can try to do it but most people would not be happy about it and somebody would still have a windmill or solar panel at their house making their own.

Above quote from: Borders, Max. The Social Singularity: How decentralization will allow us to transcend politics, create global prosperity, and avoid the robot apocalypse

Above quote from: Gilder, George. Life After Google: The Fall of Big Data and the Rise of the Blockchain Economy

How much TIME does it take to write a block? In Bitcoin? In Kaspa?

If the Federal Reserve really wants to get into the cryptocurrency business they need to invest in a crypto that is already out there. They don’t have time to make their own. That ship has already sailed. It takes too long to become secure. Just buy Kaspa (KAS) good ole sound digital money. Best name and price for the job. They wouldn’t get them all though because I’m not planning on selling. Yet.

You don’t have to cash it out if you use it as cash.

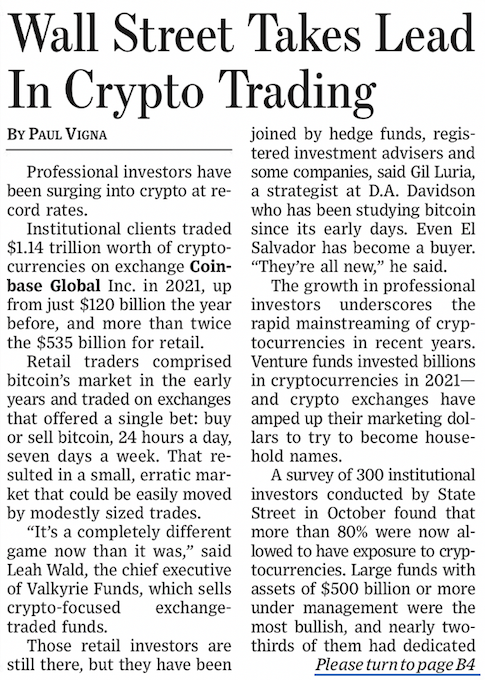

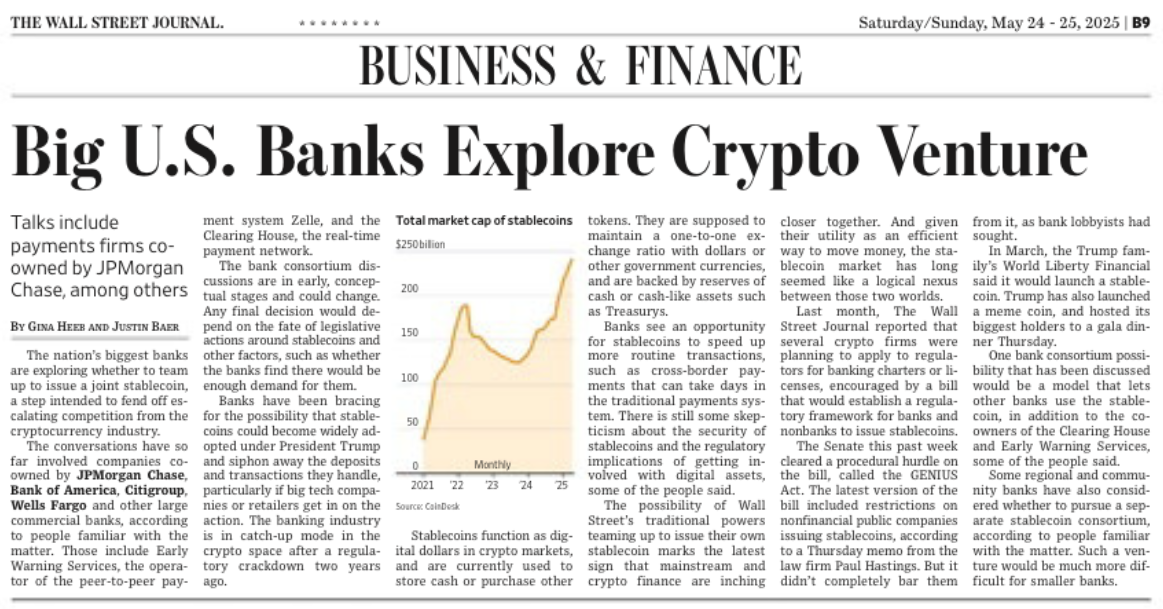

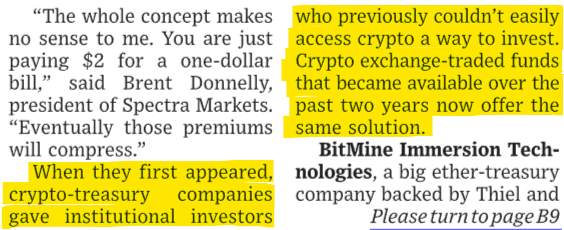

It cracks me up when I read the Wall Street Journal and they have these stories about people investing in companies that invest in bitcoin and I’m thinking, "Just buy your own bitcoins. Geez."

If it’s not your private keys it’s not your bitcoin.

One of the advantages of bitcoin is it does not rely on a trusted third party like a bank. Another advantage is that there is a limited supply. Only 21 million bitcoin will be mined and currently there are about 18.6 million in circulation unlike the dollar where trillions have recently been added to the supply.

The value of bitcoin will increase whereas the value of the dollar will decrease. Having the bitcoin in a hard wallet is the smart play compared to investing in some company that may or may not have the bitcoin.

Storing your money in stable coins is about as bad as storing your bitcoin on an exchange. Sketchy mcsketchins.

The dollar is just becoming a number on the screen and people aren’t going to want to convert something valuable into something virtual. Such as converting bitcoin to dollars. It will more likely be the other way. It’s not bitcoin that’s volatile it’s the dollar that’s being compared to it. One bitcoin out of 21 million hasn’t changed since it started.

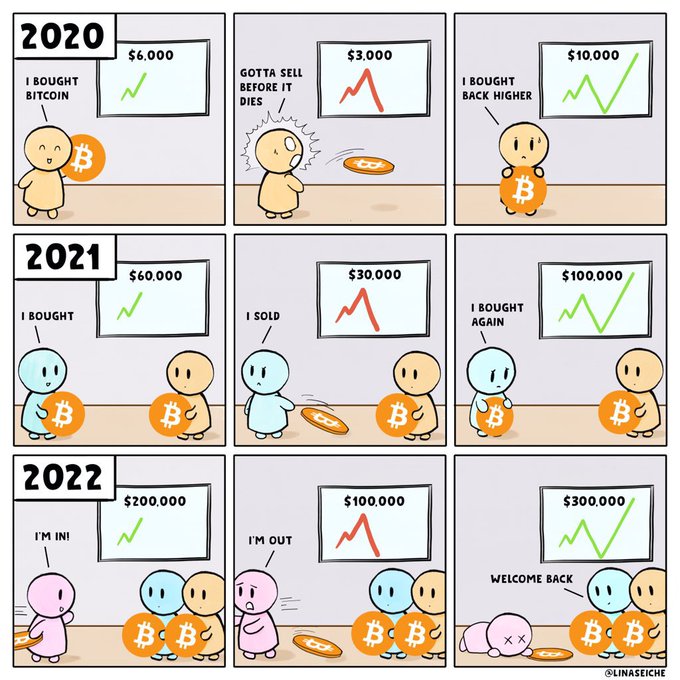

Bitcoin does not have bubbles. If you buy bitcoin today and it drops in price then in roughly 3 years the price that you bought it at will be the average price anyway. It’s a long term investment.

It wouldn’t surprise me if bitcoin was $8,000 or $117,000 on June 24th. But it would surprise me if bitcoin was $7,000 or $120,000.

People holding gold might be inclined to say, "well I guess we could just wire our house with it". Gold is actually a very good corrosion-resistant conductor.

Wall Street Journal articles about bitcoin are a day late and a Satoshi short of telling the real story.

The rise in the price of bitcoin is not so you can take profits, it’s in setting a new benchmark knowing that the price won’t go below a certain value anymore. Hodl your bitcoin and buy when it goes below the average. Accumulate as much bitcoin as you can. Don’t sell it. It’s too valuable. It would be like selling diamonds for carbon. You can borrow against it if you need to.

You don’t have to cash it out if you use it as cash.

You don’t want to take profits in something that loses value. Especially if you gave up something that increases in value.

The way to stop loss bitcoin is to buy more.

You’re not going to be buying a cup of coffee with bitcoin. You don’t buy a cup of coffee with gold do you? That’s what Kaspa is for.

I sent enough Kaspa to cover the cost of a coffee and you know how much the fee was? It was zero cents. You know how quickly it transferred? It took 3 seconds to send and 7 seconds to be received. Why wouldn’t a merchant accept Kaspa? No 2% merchant fee with Kaspa.

You don’t have to cash it out if you use it as cash.

Fiat is flabby but crypto is hard.

Electric cars are a fad. They’re just not practical. Their mileage is limited and charging times are too long to be practical for trips or getting stuck in traffic. Where do you think the electricity comes from to charge an electric car? Mostly from a gas or coal powered power plant. Crypto on the other hand is quite practical. Mileage and charging times just make it more valuable and secure.

Once dollars go into bitcoin they become more valuable.

Fake dollars becoming real Satoshis. Wow.

A dollar can only be worth a dollar. Whereas a bitcoin can be worth more and more dollars.

You don’t have to cash it out if you use it as cash.

A newly printed dollar is like a new car. As soon as you drive it off the lot, it’s worth less.

A central bank is a terrible idea. No one bank should control the money. Thank goodness crypto came along.

You can think of bitcoin and kaspa as decentralized banks. My bitcoin bank has been paying me around 100% on my deposits lately but can’t say the same for my savings in my Traditional bank.

Investing is getting easier. It use to be buy low and sell high. Now it’s just buy low.

Dollars are becoming like coal that you can shovel into bitcoin to burn and turn into energy. Good thing they are made out of paper.

Traditional banks better buy up all the Kaspa and change their name to the Bank of Kaspa or they may not have any customers left when people find out about Kaspa and start taking their money out of Traditional banks and putting it into Kaspa instead. They won’t get them all though. Because I’m not selling. Yet.

There are only going to be around 28.7 billion Kaspa and when people just keep putting more and more money into the Kaspa bank the value of each Kaspa has to go up. That’s what a limited supply will do for you. Buy and hodl.

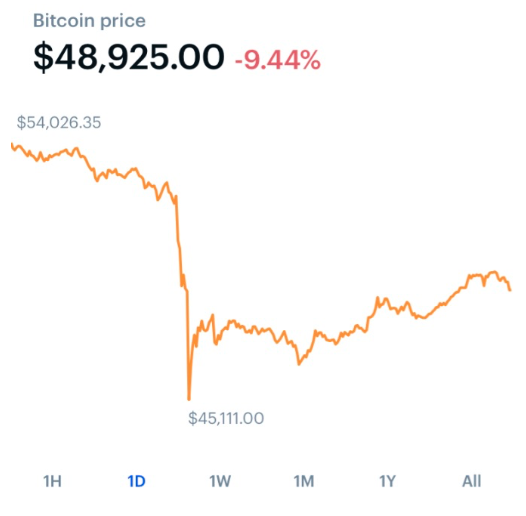

Look what I found in the Wall Street Journal on April 17, 2021 in an article titled "Turkey Set to Ban Crypto Payments". Seems pretty accurate.

Easy solution. Just hodl.

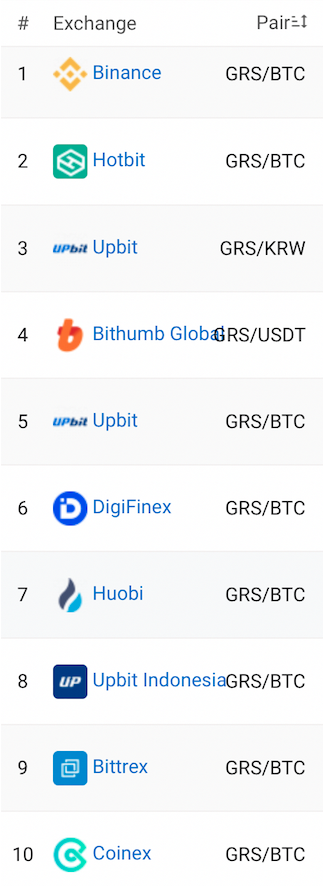

One of the nice things about Kaspa is it’s NOT on a large exchange where you can exchange USD for KAS. You have to swap to get it. Many advantages to this.

Don’t be a turkey. HODL KAS.

Ten full pages dedicated to bitcoin in the Wall Street Journal. Dang. Be pretty tough to ban it now.

I like litecoin but kaspa is roughly a 200 times better investment than litecoin. That’s a lot.

If you are wondering if putting dollars (aka fiat) into crypto is a good idea listen to what Greg Foss has to say about fiat.

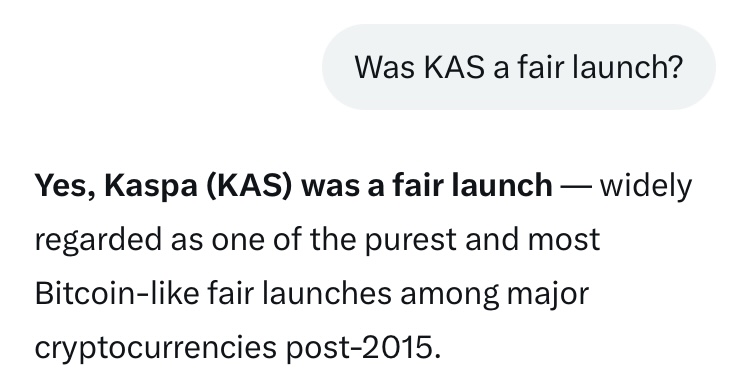

The title of the bitcoin whitepaper was "Bitcoin: A Peer-to-Peer Electronic Cash System". The coin that best represents that title is actually Kaspa.

If the Fed wants to print money and then put it into bitcoin the best thing I can do financially is buy more bitcoin because they will increase the value of bitcoin by pumping money into it. If the Fed wants to print money and then put it into the economy the best thing I can do financially is buy more bitcoin because they will decrease the value of the dollar by printing more of them.

If the Fed prints 21 million dollars and puts it all into bitcoin then they will raise the value of bitcoin but not the value of the dollar. If the Fed prints 42 million dollars and puts it all into bitcoin then they will raise the value of bitcoin more but not the value of the dollar.

The Fed just needs to start putting printed dollars into Kaspa.

Warren Buffet is quoted as saying. "You’ll see way more stocks that are dramatically overvalued than dramatically undervalued. It’s common for promoters to cause a stock to become valued at 5-10 times it’s true value, but rare to find a stock trading at 10-20% of it’s true value." The same could be said about cryptos like Kaspa. Compare Kaspa to Litecoin and Dash.

There is no exchange that offers KAS for USD. Not even the Fed can buy Kaspa without first buying a crypto and then swapping it for Kaspa. I just think that’s funny.

You don’t have to cash it out if you use it as cash.

If electric companies start taking bitcoin it wouldn’t surprise me if miners still pay in dollars because they want to keep their bitcoin.

The dollar is necessary so we can see how many more dollars the crypto’s are worth.

The only application for the blockchain is for electronic cash and specifically one that uses proof of work. If it’s a token it doesn’t need a blockchain. If it has coin in the name and a limited supply and uses proof of work then it needs a blockchain.

Who would buy an electric car using bitcoin? Two wrongs don’t make a right. For one, you HODL your bitcoin, you don’t sell it, and two, electric cars are just surrogate fossil fuel burners. Where do you think the electricity comes from to charge an electric car? Mostly from a gas or coal powered power plant.

Two things to avoid if you can. Making eye contact with roving Mariachis and selling your bitcoin.

Lots of people have dollars but not a lot of people have bitcoin. There is no limit to dollars but there is a limit to bitcoin. Demand and Supply vs Supply and Demand. I like the home team in this game.

Michael Saylor and Saifedean Ammous talk about bitcoin in the audio clip below. Don’t sell your bitcoin.

Reaching consensus in social interaction does not necessarily mean that we have arrived at the correct conclusion. In many cases it just means we’ve reached a comfort zone. What do you believe in?

People are just going to have to get use to being their own banker. But once they are. Look out.

Bitcoin rewards consistent investment and patience but not so much the greedy or impatient investor.

I’ll pay you in cash if that’s ok could become I’ll pay you in Kaspa if that’s ok.

You don’t have to cash it out if you use it as cash.

If you’re going to sell something and you will only accept Kaspa as payment, chances are the person who eventually pays you will be good for it. Not only that it will level the playing field, it won’t be first come first served, and the people involved will learn a little bit about cryptocurrency.

People selling houses and cars should only accept Kaspa. It will drive the banks out of it. Not to mention bring attention to the cryptos and usher them into the mainstream.

It would have to be Kaspa because the smart investors wouldn’t want to part with their bitcoin.

If cryptos are a property and subject to Capital Gains or Losses then either our crypto investment will pan out or we won’t have to pay as much in taxes. Seems like a win-win.

Once wealthy folks and their friends realize they can essentially adopt a coin like Kaspa and stuff lots of money in it and see a rate of return unlike what they see in the markets and even real estate, look out. If they stuff enough in and become a whale they can have a measure of control they wouldn’t have in the other markets.

Nice thing is we can all adopt Kaspa and the wealthy folks can’t say no. They wouldn’t want to even if they could. The more the merrier.

You don’t have to cash it out if you use it as cash.

You want to negotiate your salary in bitcoin not just get paid in bitcoin.

The bitcoin whitepaper was titled "Bitcoin: A Peer-to-Peer Electronic Cash System". Tesla is not my peer. What’s really going to get this thing going is peers deciding to use this electronic cash system.

If everyone in the US took 10 dollars and bought Kaspa that would infuse $3,327,348,390 into Kaspa. There are currently only 24.69 billion KAS available. So even assuming no increase due to supply and demand the value of that $10 would become $18.00. That’s an 80% increase in value. Where else in the markets would you get an increase like that? Not only that people could use it to pay each other. Wow.

How many fires can the Fed put out? Water isn’t the problem. It’s identifying who needs it and how to get it to them, which takes time and energy and in that time more fires keep cropping up. Time and energy becomes the issue even for the Fed. That is not very socially efficient.

Learning which is essentially processing takes time and energy. Efficiency is about learning or processing more at the same rate or learning or processing the same amount in a shorter period of time. Crypto transfers more value in a shorter period of time peer-to-peer making it doubly socially efficient.

Cutting out the middle man helps with efficiency.

The bitcoin train is getting ready to leave the station. The conductor has disappeared and the train is limited, meaning it’s offering faster service especially by making a limited number of stops.

Full page ad in the Wall Street Journal.

So who is selling bitcoin? What are they doing? Collecting fiat currency by giving away a hard currency. How does that make sense? You know that if very few people sold and would only sell at a very high price that the price would go up. You know that, right?

You don’t have to cash it out if you use it as cash.

Either the market is free and buying and selling determine the price or the market is fixed and someone is just clicking a mouse and deciding the price. I would like to know who the mouse clicker is.

Nick Szabo knows about those mouse clickers.

Peter McCormack and Greg Foss on volatility.

Satoshi didn’t mention anything about derivatives in the bitcoin whitepaper.

Satoshi might of mentioned the Fed in the bitcoin whitepaper when the Gambler’s Ruin problem was introduced.

This pretty much tells the story.

I knew when I had to paint my fence government brown that freedoms were starting to erode. Just makes me want to get more private orange money.

If I were to guess how many people were Satoshi Nakamota I would say 2. Satoshi and Nakamota.

Crypto is the modern day Homestead Act. I’m putting my claim on bitcoin and kaspa acres (coins).

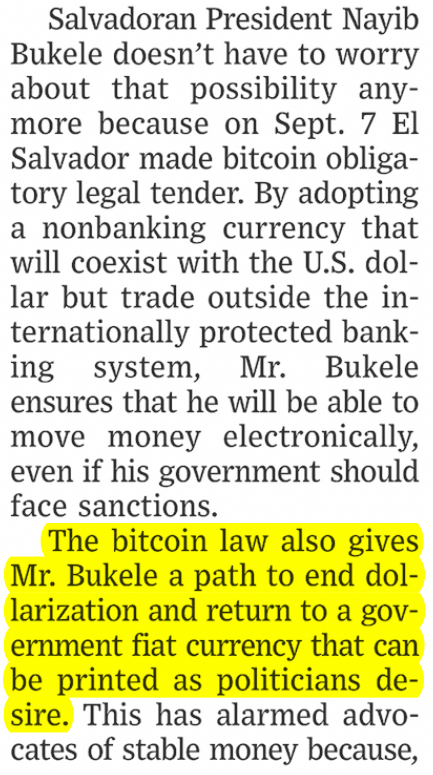

The Wall Street Journal on 8/27/21 talking about El Salvador adopting bitcoin as a currency. You know what this means? Buy low and sell high will be the Salvadorans new job.

The volatility fix (instant convertibility) will just keep the BTC price going up when the Salvadorans learn how to convert high and convert back low. This is hilarious.

Tiny El Salvador is about to become Big El Salvador.

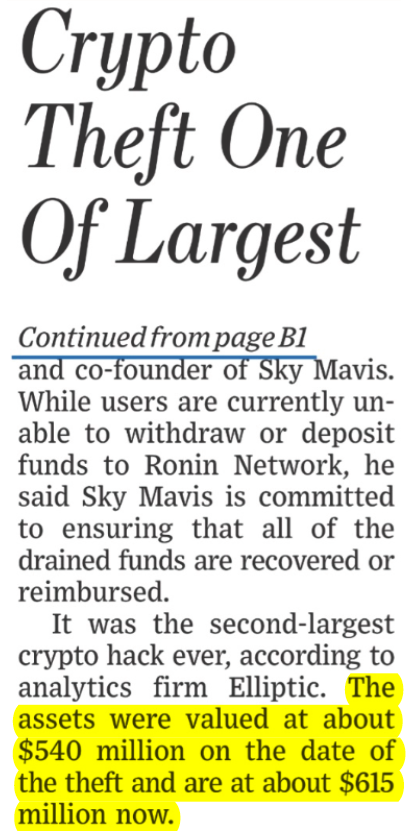

Pay no attention to the "anonymous and illicit transactions, like money laundering or ransom payments" BS as a few weeks earlier the Wall Street Journal wrote in an article the following.

I wouldn’t be surprised if Salvadorans buy and sell stuff in USD. But save and transfer in BTC. How much that spreads around the globe is anyone’s guess.

I agree with Will Clemente III but I think there is more to it than that. It’s look here not here as the mouse clicker goes about his business.

This is great. Every time a country adopts bitcoin we can just buy the dip. Old limit orders filled. Thank you very much.

It’s like trying to sleep in on trash day.

Just so you know. If there is a climate crisis it’s caused by printing money. The energy budget must be balanced.

What’s this bull and bear talk. You know bitcoin is not a stock, right? It’s a peer-to-peer electronic cash system that society is in the process of determining a value for.

It’s so nice of the Swiss regulator to grant two licenses. It’s like Blockbuster granting Netflix access to the internet to sell videos. Geez.

Not sure the Wall Street Journal knows what hard money means. They have it just the opposite. They should have written hard money instead of digital currency and easily debased fiat currency instead of hard currency.

I think the people are starting to figure it out.

You don’t have to cash it out if you use it as cash.

Apparently the Wall Street Journal doesn’t know that dollarization is "a government fiat currency that can be printed as politicians desire".

That’s the point of cryptocurrency. Does the Wall Street Journal not understand how cryptocurrency works?

Ask the corrupt politicians about moving around pallets of cash. They can tell you all about it. However, they probably won’t tell you that the pallets of cash are harder to trace than bitcoin transactions that are on a public ledger for all to see.

Video of Fed giving fiat.

Seems like a bad combo.

Bitcoin hodler theme song thanks to Willy Woo.

Even in sports they’re making the connection.

So if the cost of something is 21 million bitcoin, what does that mean?

So if the SEC inadvertently pushes everyone investing in crypto into bitcoin you realize the price of bitcoin will go up, right?

They might have to rename the Dollar Tree store the Satoshi Tree.

It’s not too secret if it’s on the front page of the Wall Street Journal.

Buying bitcoin is a way to sell US dollars and still have money.

If you have the same money that the Fed prints and then buys it’s own stuff with then that money you have becomes worth less. Bitcoin is not that same money.

Bitcoin is money it’s not a stock.

You don’t have to cash it out if you use it as cash.

ETF’s of bitcoin are a diversion. Look here not here.

The volatility of bitcoin is an asset not a liability. It keeps governments from riding the bucking bronco.

When the internet first became a thing people were calling it the information super highway and after seeing how things were going I said I wouldn’t be surprised if it turned out to be the mis-information super highway. This was in the 90’s by the way.

It’s looking like the only thing you can trust on the internet these days is bitcoin.

About the only thing this Wall Street Journal article got right was the title.

When an article has more than one author that’s a heads up that some of the info in the article is not accurate. But they can just blame the other guy or gal.

It’s riskier to buy gold than it is bitcoin. Unless you can tell something is pure gold just by looking at it.

Which of the 3 writer’s picked this word. Is this responsible and accurate journalism? Sounds more like a narrative pushing opinion. You know how much bitcoin is worth, right?

Like I said earlier. Volatility is a good thing. It keeps governments from riding this bucking bronco.

What’s the phrase? Gradually, then suddenly.

You can’t really buy or sell paper bitcoin. Cold storage hardware wallets will see to it. Get your bitcoin off the exchanges and don’t participate in the futures market.

Nobody that I know is longing or shorting Kaspa using derivatives or futures contracts and taming the price like what’s happening to bitcoin. Maybe that’s because it’s a peer-to-peer electronic cash system that I use to tip the lady that cuts my hair.

This was actually a very well written article. Notice there is only one author.

In case your wondering what a bitcoin futures contract is.

The long story short on a bitcoin futures ETF (pun sort of intended).

Are you buying the dip or buying back in?

You don’t have to cash it out if you use it as cash.

Long liquidations are forced sellings for a reason. For a rocket to fly higher and faster sometimes it has to get rid of some of its unnecessary baggage. If you’re going to second guess bitcoin you’re not going to be allowed to ride to the next destination.

Short liquidations are forced buyings for a reason. For a rocket to fly higher and faster sometimes it has to get some fuel for the trip. If you’re going to second guess bitcoin you’re going to be paying for the ride to the next destination.

Bitcoins are worth money because people are buying them with money to use as money. That has been perverted by people betting on whether the price of bitcoin will go up or down.

Why is gambling being so heavily promoted these days?

Plan B.

It seems that the legacy financial folks think bitcoin is this cute little pet they can put a leash on.

This is the leash that was reportedly used in late 2017 and early 2018 and possibly is still in use today.

It wouldn’t surprise me if today they are playing both sides of the fence. Opening up both long and short positions. Money isn’t the issue. They can print as much as they want but they need to preserve the system that allows their printer to work.

What they don’t get is that bitcoin won’t stop until it’s king of the monetary hill. But that’s ok.

Maybe it won’t because it can’t. Cream always rises to the top.

Wait, so this Wall Street Journal writer who 3 weeks ago said that bitcoin was a fad is now saying its systemically important. What?

Could end up being a very expensive book. Maybe not a $300 million dollar pizza, but who knows.

Paper versus digital versions is even making it’s way into the Wall Street Journal. Kind of like currency. Not the same though. The title’s are different. Interesting. It does show the crypto replacing the traditonal system however.

These crypto companies that are naming arenas in the United States don’t even have their headquarters in the US. Wouldn’t suprise me if they try to pass a law that says only companies with headquarters in the US can buy the naming rights for US arenas.

This pretty much sums it up.

So where does that money go that’s being printed to suppress the price of bitcoin? Just look at the price of real estate and goods and services.

Bitcoin is not a stock. Bitcoin is not gold. Printed money backed bitcoin futures are empty bags and any effort to supress the free market price of bitcoin will show up as inflation.

The Fed doesn’t care if their longs or shorts get liquidated as long as the price of bitcoin goes down. They’ll just print more money and get ready to do it again.

China bans bitcoin and the Feds tank it. It’s a matter of survival. Keeping their system in place.

Don’t forget about the price being dropped by a click of the mouse so your buddies can get in at a discount.

There are things that are not on-chain that affect the price of cryptos.

Crypto exchanges are largely unregulated and run by software. Software can be programmed to do some interesting things.

Buy crypto at a bargain price and get it off the exchange.

Models work until they don’t. Then it’s time to get a new model or get out.

Why didn’t the Wall Street Journal mention the Fed printing trillions of dollars?

Bitcoin. The gift that keeps on giving the whole year.

The cat is out of the bag and now there is a whole herd of them. Does the Fed know how to herd cats? Even if they do many of the cats are outside their jurisdiction.

The thing most people can do with bitcoin that they don’t with gold is download it to their hardware wallet. That’s when the Fed’s paper bitcoin won’t work.

There is a difference between fake (unlimited) money and real (scarce) money. When a system is backed by fake money like fiat and things start to go bad the backstop will be exposed for what it is, fake. When a system is backed by real money like bitcoin and things start to go bad the backstop will be exposed for what it is, real digital processing energy used to secure a network that does just what it has been programmed to do since Jan. 3, 2009 for all to see.

You can buy real (scarce) money like bitcoin with fake (unlimited) money like fiat. But you can’t buy real money like kaspa with fake money like fiat. You need to buy real kaspa with real money like bitcoin. That’s a real money protection that many coins don’t have.

Apparently the Turks don’t think it is riskier.

The time to pile into crypto is before inflation not after.

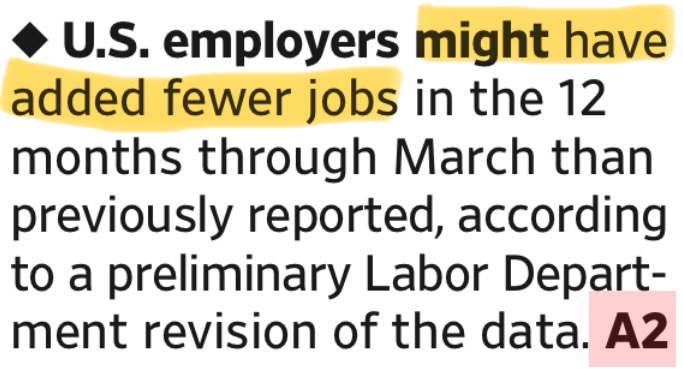

Why hold stablecoins pegged to the dollar? The dollar is fake just like the lira. The dollar backers are just better at disguising its fakeness. Just buy bitcoin or kaspa and move into real money.

Trading cryptos misses the point.

Fiat is a physically dirty form of money.

If you own kaspa you own bitcoin. KAS-BTC pair.

If you end up with more bitcoin than you started with after all this mayhem then you’re doing something right. What’s volatile is the number of dollars not the number of bitcoins.

Paper bitcoin is not bitcoin. The bit in bitcoin means something.

When buying and hodling happen under suppressed paper bitcoin prices it is just setting up a short squeeze for the ages.

At least they consider it an industry.

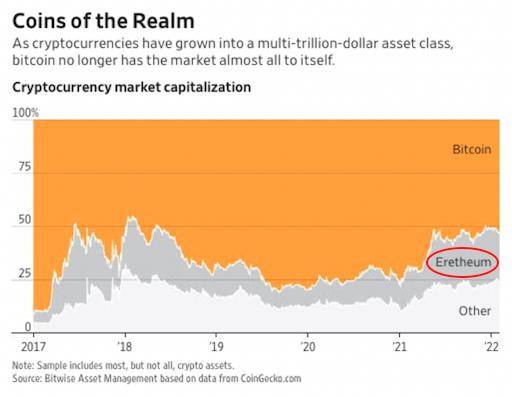

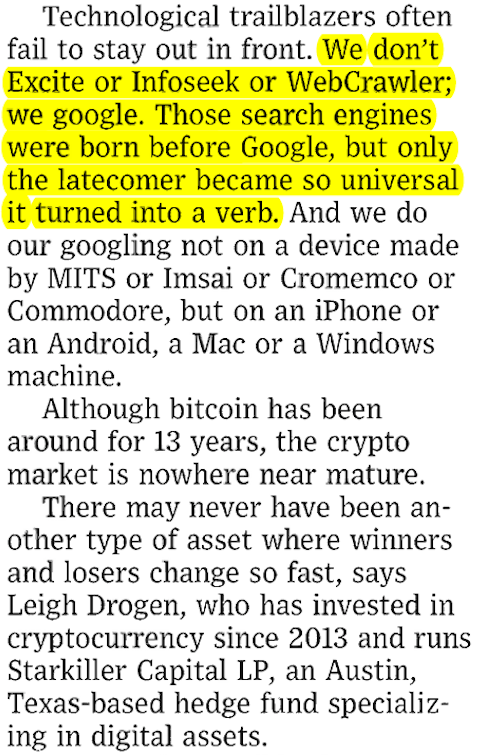

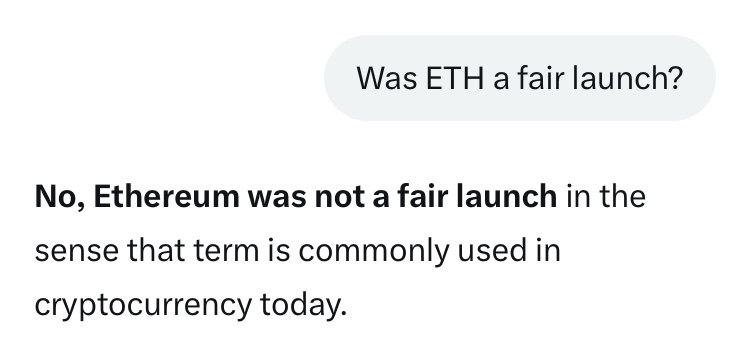

I guess we can see what the Wall Street Journal thinks of ethereum.

I don’t think Excite, Infoseek, WebCrawler, and Google were trillion dollar assests. I kind of liked AltaVista anyway.

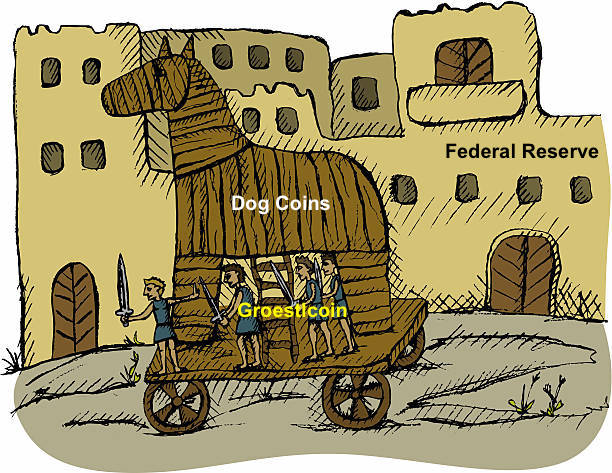

A new Trojan Horse.

Willy Woo on Jay Gould.

Well looky here.

When prices are controlled the legacy system is happy. As long as they are the ones controlling the prices. That’s one reason why inflation is a problem for them.

Sometimes things move forward whether people like it or not.

The United States of America is decentralized. Just ask Texas and Florida. Fortunately so are counties inside of states and so are towns inside of counties.

While government’s were busy trying to exert control over their citizens, money went global. It’s now beyond their jurisdiction.

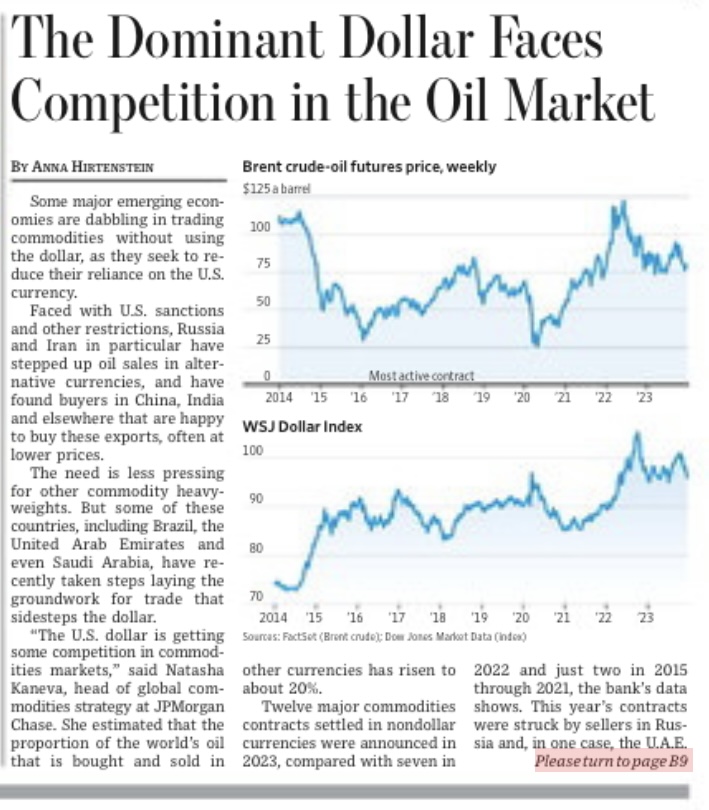

It’s not just dollars that are being used to buy bitcoin.

Why kaspa? Because it’s backed by bitcoin. Not many coins can say that. Even litecoin is backed partially by fiat. Currently so is bitcoin. Any coin that has a USD pair is partially backed by fiat.

Stack Kaspa while you can.

Storage is important. The more an object requires it the more vulnerable or dependent it is. How much storage does bitcoin require?

Since banks don’t hold much cash these days the only way to do a bank run is to buy bitcoin with your money using an online withdrawal. Using savings is even better because the chances are the banks have already loaned that money to the Fed to pay for their debt. Oops.

Here we go again. More than one author Wall Street Journalism’s negative narrative pushing adjectives. They even threw in a transitive verb for good measure. The article would read better without them.

An adjective is a word used to qualify, limit, or define a noun, or a word or phrase which has the value of a noun.

A transitive verb needs to transfer its action to something or someone—an object.

You don’t have to cash it out if you use it as cash.

The real problem with bitcoin for a lot of people is they can’t see it or touch it. It’s kind of like light. You can’t see or touch light but you can see the reflection and feel the absorption of light. I guess with bitcoin you can see the number reflected on the wallet screen and feel the freedom of the completed transmission.

A windy day will show a weakness in a fence. Even more so if the winds change. F=ma. Force equals mass times acceleration and acceleration is the change in velocity.

I heard the wind and even the house creaked. But when I looked at the windmill behind the house it was still. Only a few seconds later it turned and started to spin. I guess I thought that the windmill would move first, but it didn’t. It depends on the direction of the wind. Data used to predict can be like the windmill behind the house.

Bitcoin is doing all the dirty work and heavy lifting to take down the legacy system. It may be that it might have to go down with the ship to complete the job. But there are Kaspa life rafts.

The people who don’t understand bitcoin will FOMO in via the legacy system which has their tools in place to control the price of bitcoin to essentially go sideways until they decide it’s time to go up or down. It’s only when the people who do understand bitcoin cause a supply problem that causes the legacy system’s fake bitcoin to crash allowing the real bitcoin to pass on it’s legacy.

You don’t have to cash it out if you use it as cash.

The legacy system figures they can control the on ramp and the off ramp and everything will be just fine. Not sure they are considering there may not be a need for an off ramp. Oops.

What a bunch of BS. Bitcoin is a peer-to-peer electronic cash system. It’s not a stock. That’s like Wall Street saying they are taking the lead on the use of the Internet. You buy bitcoin to use as cash or save as a store of value. Trading bitcoin is a sideshow, hobby, or perversion of the original design.

Wait. I thought you said that crypto was a fad and for criminals.

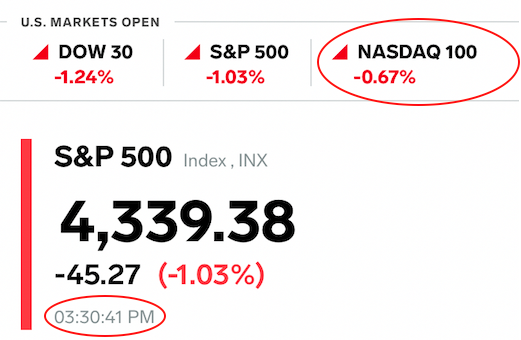

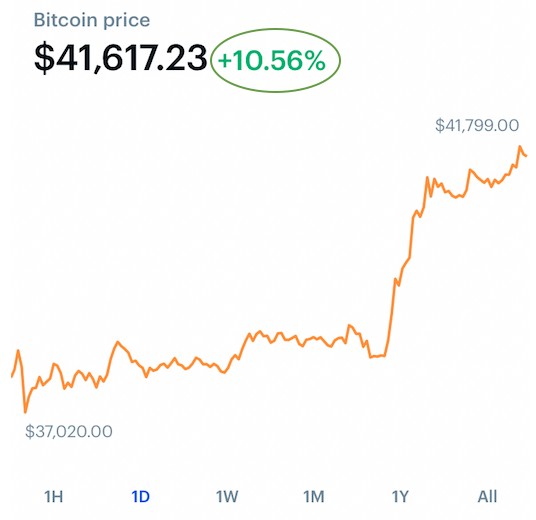

Lockstep? Same day a minute apart.

So the Fed pumps up the stock market with fake money while bitcoin gets pumped up with real money. How is that the same?

The fiat system was designed to fail. That’s the point.

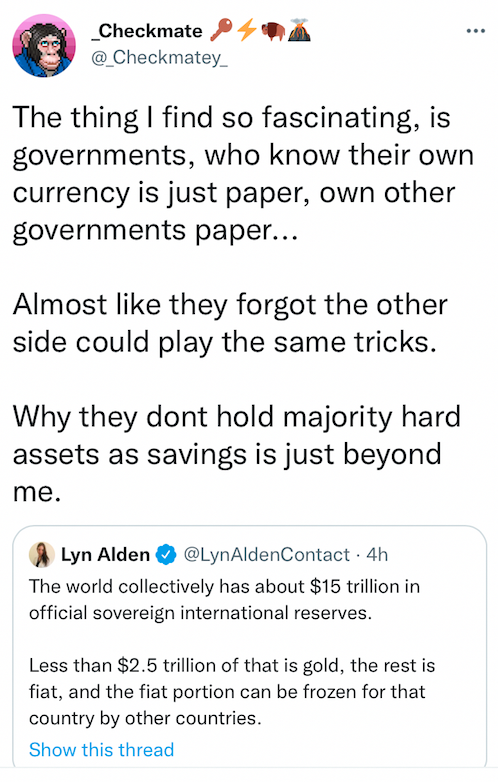

@_Checkmatey_ and @LynAldenContact know about fiat.

The real bitcoin rush will begin when huge stores of gold are found.

The only money that grows on trees is made of paper.

You can buy gold so that when the price goes up you could use the profits to buy bitcoin.

When it comes time to claim your paper bitcoin they could say we don’t have your real (scarce) bitcoin but here is todays value of it in dollars. You wonder how many people will be ok with that? They’re not equipped to do that with kaspa. Kaspa can jettison when the time comes.

ETF: All we have is paper bitcoin or dollars.

Investor: But paper bitcoin and dollars aren’t scarce like real bitcoin is.

That’s why you don’t trade a peer-to-peer electronic cash system.

Could owning some bitcoin be like owning a finite share of the value of the internet?

Hydrogen can be electrolyzed from water using a windmill.

Hydrogen can be used as a fuel in place of oil and natural gas.

One nice thing about the altcoins is they can go on these huge runs and the futures and derivatives markets can’t do anything about it.

So what happens to the other 75 million dollars?

So bitcoin would no longer be bitcoin.

So how is it that the altmetals reached new highs but not gold and silver?

Derivatives are basically slopes and slopes can be slippery.

Arthur Hayes sums it up.

Storing dollars in PoW coins that have a limited supply and that you can control by downloading to a hardware wallet and is not part of the legacy (inflation of the dollar) system seems like a good idea.

Limited supply PoW coins print dollars (inflation of the dollar for that coin as price increases due to a limited supply of the coin). The Fed is not the only one that can print dollars.

As long as the Fed is trying to control the price of bitcoin there will be inflation of the dollar. If the Fed lets bitcoin naturally increase its price in dollars there will be inflation of the dollar. Wait, what?

It seems storage is vastly underrated.

ETF: Here’s the dollars you won by shorting bitcoin.

Investor: I don’t want the dollars, I want the bitcoin.

Isn’t that how it should have been all along?

There are probably a lot of people who have ideas on that.

That’s because bitcoin is not a stock. It’s a peer-to-peer electronic cash system.

Exchanges when there is a late night run on bitcoin.

I remember when IOTA had some security issues and had to shut down it’s network for a few weeks but the price of IOTA moved up and down just like all the other cryptos even though there was no way to trade it. How is that possible? Unless, there was some funny business going on.

When electrolysis was used to extract aluminum from molten ore in 1886 the price went from $100 a pound to $0.50 a pound. Would that happen to gold if huge stores of it are found?

I was wondering why the big push for exchanges to advertise so much lately.

As long as bonds are denominated in dollars they will end up being worth less.

The longest shot has won the Kentucky Derby.

Rich Strike wasn’t in the Derby field until Friday when Ethereal Road was scratched.

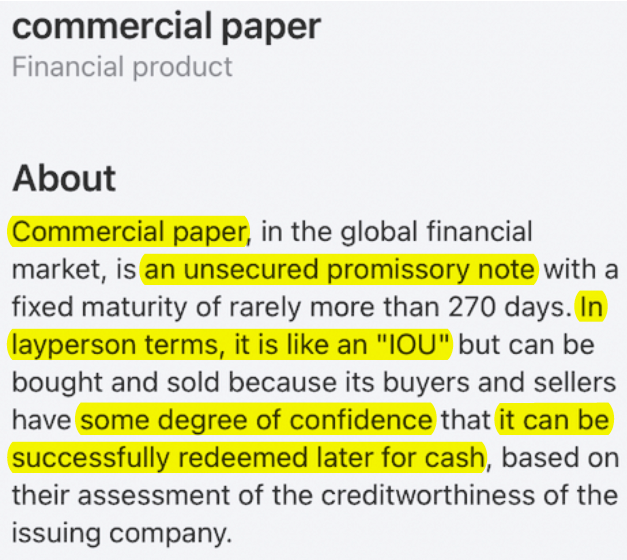

All stablecoins have the same issue that could be dubbed (PoB) or proof of backing that requires a trusted third party.

So is the US weaponizing the dollar, and Russia weaponizing energy, and China weaponizing supply chains, and the Wall Street Journal weaponizing the word as?

The value in a book is the ability to read it and learn from it. Not to just have and look at it. The value of digital scarcity (bitcoin) is the ability to transfer it privately and securely knowing it cannot be copied. Scarce books can be photocopied and still transfer their value. Digital scarcity means that its value cannot be copied.

If a country bought up as much kaspa as it could and then received payment in it for its commodities they could essentially be getting paid twice.

When will miners and exchanges stop accepting paper money for bitcoin?

When the Fed’s printing press isn’t running you get a clearer picture of the markets. Pretty tough to sell when there’s no buyers and pretty tough to buy when there’s no sellers.

Stores are storage. Look at the shelves or in Walmart’s case look at the cluttered aisles. That tells the story. Supply and demand.

The problem with bitcoin is you can buy it with the paper dollar which diminishes its value. You can’t do that with kaspa.

Tough to collect on a bet when the counterparty disappears.

There is no place to hide on a public ledger. Paper bitcoin is not real.

Induce a recession? It's already here.

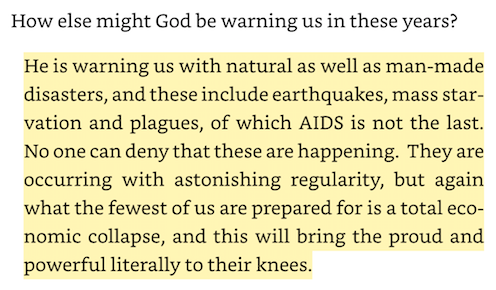

Maria Simma knew.

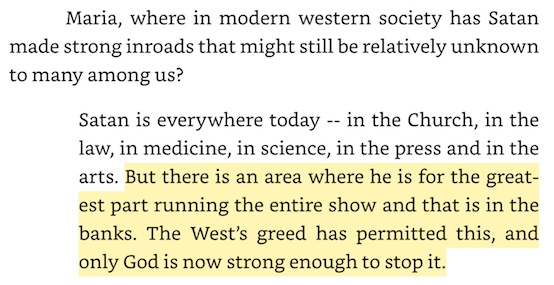

That's the backing?

Where's all the money?

That's as good as money, sir.

Those are IOU's.

Every cents accounted for.

That's a car.

It’s possible all countries will be forced into using a neutral currency and that road leads to PoW crypto.

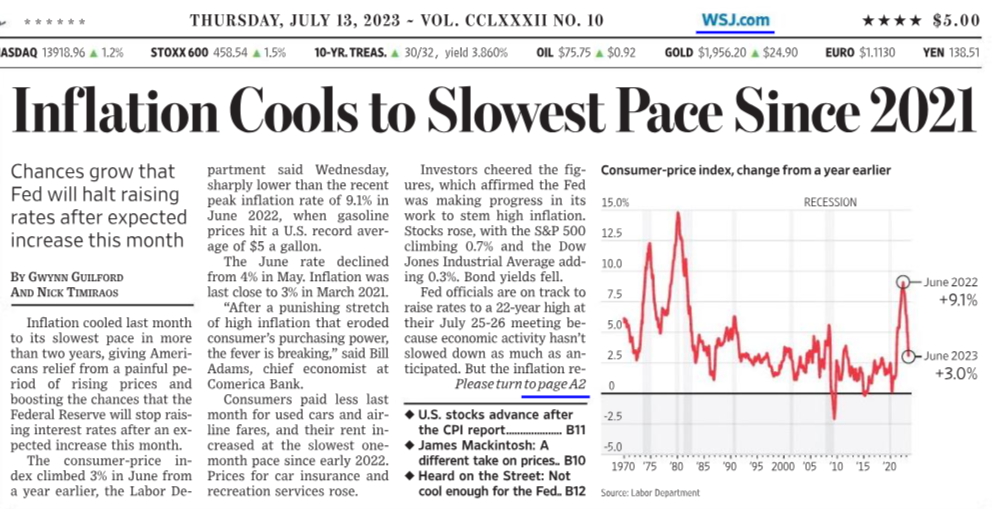

A decrease in the rate of increase is still an increase.

Buying your own stuff doesn’t get rid of your stuff or pay the bills.

You don’t have to cash it out if you use it as cash.

Paper money may be real but is it valuable? It can only maintain value as long as they stop printing it. There is no guarantee they can stop. I’m not they.

If the central banks really wanted the best money they would be moving to convert to a bitcoin and kaspa system ASAP, but they aren’t which pretty much tells the story.

My guess is Visa and Mastercard will lose their best customers to crypto and be left with those that use the credit part of the credit card.

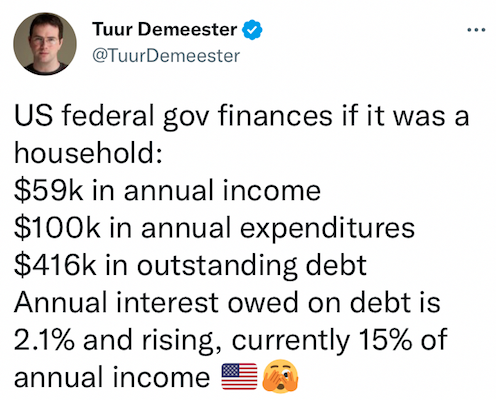

“So how is all of this going to play out? I don’t know exactly and um frankly I don’t care all that much because I own bitcoins.” Tuur Demeester

Seems like they used the pandemic to get Trump out and destroyed their fiat system in the process.

The only way to keep the fiat system alive is to print money but printing money is what causes inflation.

When things are really happening there usually isn’t any media around to take pictures.

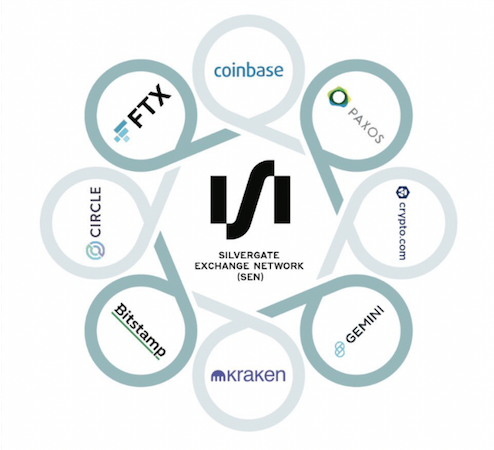

This has sketchiness written all over it. The usual cast of characters. Bailout candidates?

If you have 1 dollar out of 100 dollars that dollar has 1/10th the value as 1 dollar out of 10 dollars. That’s what happens to the value of the dollar during inflation. It decreases. Inflation is when more dollars are printed. That’s it. Sometimes it shows up in increasing prices but that’s just another way of showing the lost value of the money.

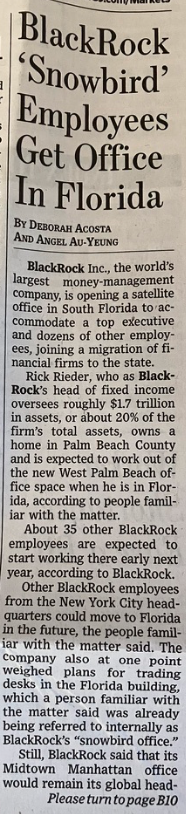

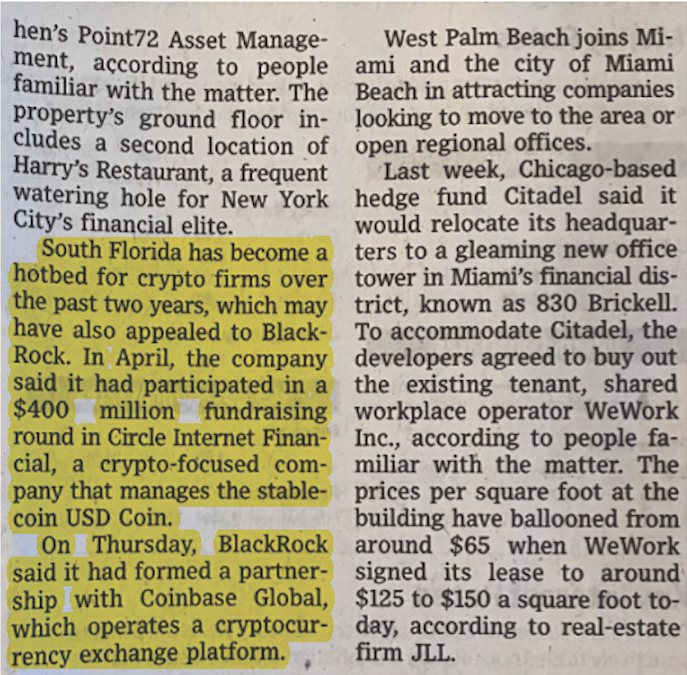

Interesting how the BlackRock article in the Wall Street Journal got moved and altered from the print version to the online version. The print version seemed much more friendly to Florida and crypto. Maybe too friendly.

Print version.

Online version. Notice BlackRock removed from front page sidebar.

Print version. Notice title includes Employees Get Office in Florida.

Online version. Title different and missing the highlighted part mentioning crypto below.

Print version.

BlackRock knows bitcoin is not a stock, right? It’s a peer-to-peer electronic cash system. These investment firms are essentially just taking peoples money (dollars) and buying a better money (bitcoin) with it. But it will not be able to be used as money because the peers (investors) won't have it in their possession to use in the peer-to-peer electronic cash system. What? Talk about a goofy, cobbled up mess. Maybe that's the plan. Good thing there's kaspa.

Maybe because they don’t want to kill another human being.

Talk is cheap.

Storage issues.

First things first.

Watching coal trains go back and forth from our back patio makes it pretty clear that current energy demands are just not sustainable. That may be a more real and immediate concern than a climate issue.

What would cause more of a supply and demand problem? Don’t use oil and gas because it’s causing climate issues or don’t use oil and gas because we are actually running out.

“I had been aware since the early 1970s that these common back and neck pain syndromes were due to repressed emotions.” John E. Sarno, MD

“There is a large number of souls who have been in Purgatory for a long time because no one prays for them." Part of a Medjugorje Message on Jul 21, 1982

Why isn’t the LED lights scam talked about? They don’t even last as long as incandescent bulbs but cost way more and are suppose to last several years.

The aisles at the grocery store I go to are starting to look like Walmart’s with all this junk in the way. Tough to get the cart through. Apparently they have nowhere else to put it. Storage is an issue.

Funny how stores are having storage issues with too much inventory but corporate makes sure the Halloween junk is out front and center over 2 months before October 31st.

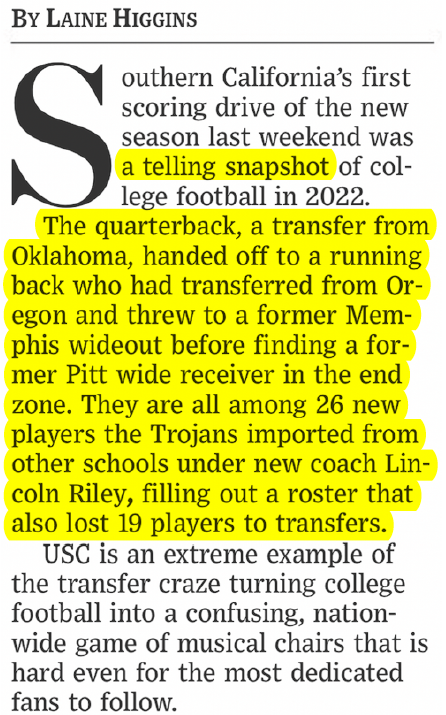

A telling snapshot indeed.

Hopefully his credits transferred.

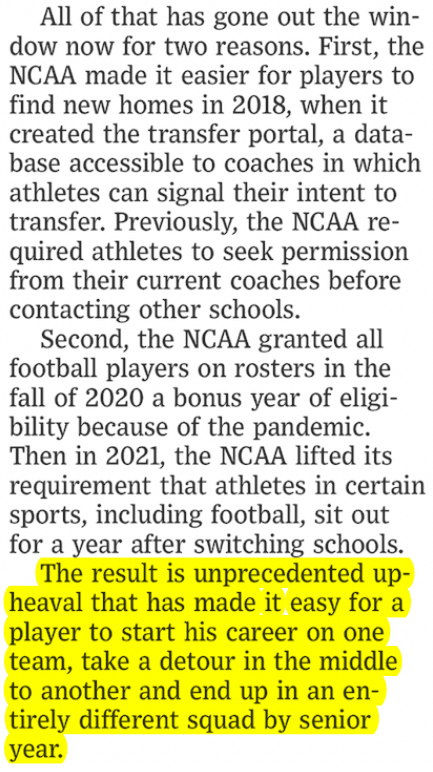

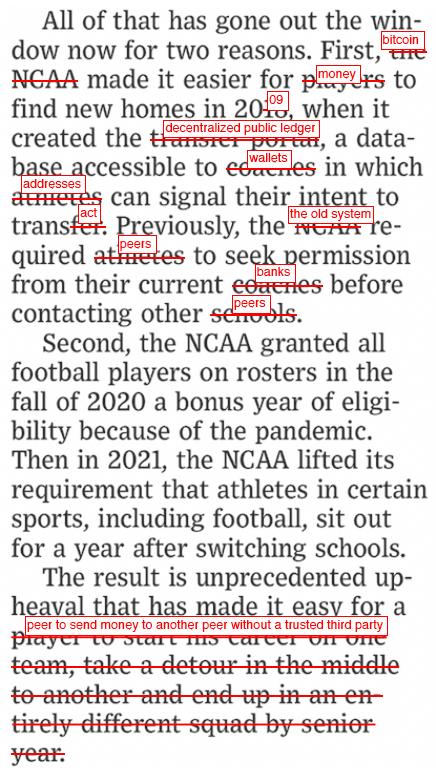

I just noticed an interesting parallel between the transfer portal and bitcoin.

It’s a good buy if it’s cheaper to buy it than it is to mine it.

You don't own bitcoin unless you download it to a hardware wallet where you have the private keys.

You want to see the price of bitcoin go up? Just download it to a hardware wallet.

You don’t have to cash it out if you use it as cash.

If bitcoin could only be purchased with other PoW coins and not dollars, futures markets would not know what to do with no BTC/USD. It makes sense that energy produced coins should be purchased with energy produced coins.

You can be a stablecoin as long as you buy our stuff.

The old, “we’ll take your comments and then use them to support what we were going to do anyway”.

The real risk they are concerned about.

Bitcoins should only be purchased from miners who set the price. If trades are involved then it should be peer to peer swaps. That’s it. If you think there should be a way to exchange bitcoin for fiat then you don’t understand bitcoin.

So how long does it take?

Unless bitcoin becomes the reserve currency, when the dollar price of bitcoin goes down it is just an indication of how much trouble the fiat system is in.

The Fed will have to print more money to keep the fiat system afloat but that will ultimately end up making matters worse.

The fix for currency debasement is built into bitcoin.

Could it be that Fidelity and BlackRock might turn out to be BINO’s? (Bitcoin in name only)

A visual for the fiat economic system.

Causing parts of the financial market to collapse is just a way to create a situation where you need to print money for bailouts. The real question is are bailouts ok?

Would a financial system based on an honest and true money need bailouts?

Bitcoin will take off in earnest when commodity suppliers realize that energy needs to be paid for with an energy money to keep the equation equal. Joules = Joules.

If bonds are denominated in fiat currencies what difference does it make?

Like if bitcoin was required to purchase oil and gas. Energy for energy.

Does that include market manipulation from the Fed?

If funds are being made available to push an agenda but there is no audit then how can it be known? Inflation?

Inflation it appears may be the audit. The laws of thermodynamics indicate that the energy budget must be balanced.

Dr. Sarno believes that TMS is an emotional barometer that physically reveals the individual’s hidden tension level. He has found that once the sufferer realizes that his pain is actually a distraction—and that he is fine physically—his pain more often disappears, because a distraction is only a distraction if one does not know it is a distraction.

The Great Pain Deception - Faulty Medical Advice Is Making Us Worse - Steven Ray Ozanich

You don’t have to cash it out if you use it as cash.

How is inflation 8.2% when the cost of one donut at the grocery store I go to went from $0.69 to $0.89. That’s a 29% increase.

Time to get some more orange money.

Jesus began to speak, first to his disciples, “Beware of the leaven–that is, the hypocrisy–of the Pharisees. There is nothing concealed that will not be revealed, nor secret that will not be known. Therefore whatever you have said in the darkness will be heard in the light, and what you have whispered behind closed doors will be proclaimed on the housetops.” Luke 12:1-3

Inflation it appears may be the audit.

You can be a stablecoin as long as you buy our stuff.

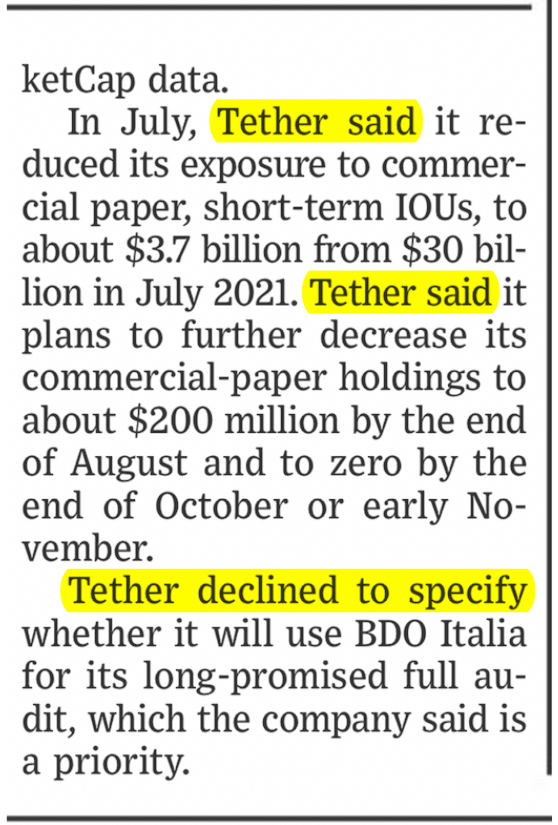

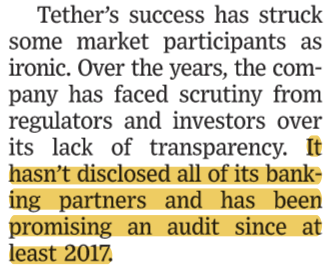

So when is the audit or will a blog post and a series of tweets just suffice?

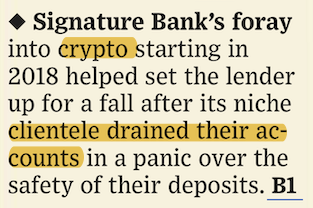

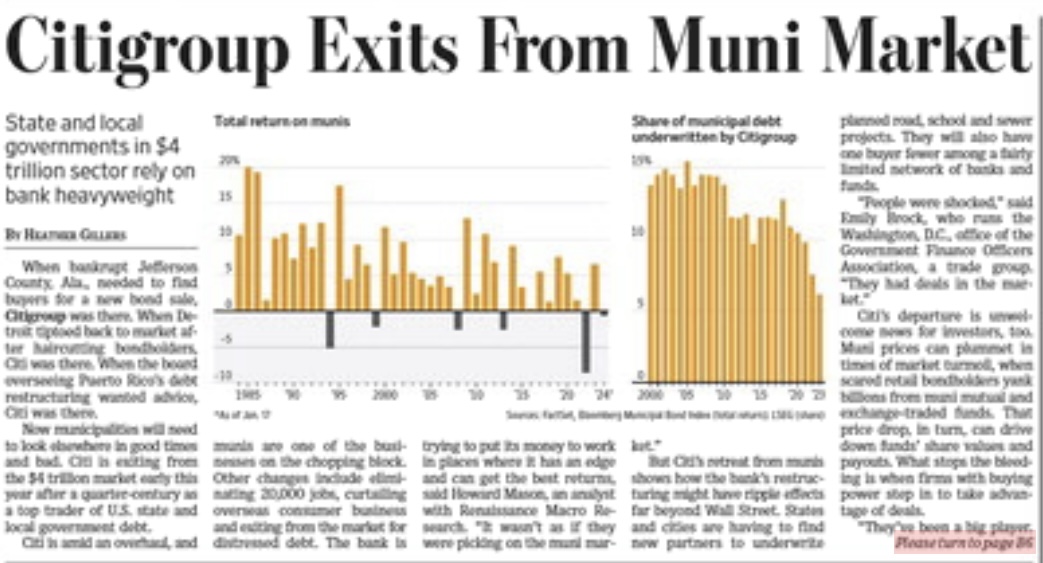

Seems crypto tends to be a front runner. Is this what’s in store for other banks and businesses?

Inflation is not a nail but the Fed insists on using a hammer to pound it down. Maybe it really doesn’t want inflation to go down. If the Fed convinces enough people that inflation is a nail they can get away with this nonsense and inflate away some of the debt in the process. More and more people are starting to see through their smoke and mirror tactics. The show is becoming old and tiresome. With HDTV makeup can only go so far until the truth is laid bare.

There are 2 types of inflation. Monetary and price. Most ordinary people seem to care less about monetary inflation but not price inflation. Monetary inflation is caused by printing money whereas price inflation is caused by energy shortages.

Monetary inflation is used to prop up the fiat system. Price inflation can only be controlled when energy production and prices are under control.

You can get away with monetary inflation when you are energy independent.

Owing yourself money is not a problem. The books balance.

I can get 8 toaster pastries at dollar tree for $1.25. That’s 15.6 cents a pastry. The grocery store can have fun trying to find storage for their over priced donuts at 89 cents. The bear was poked.

It appears globalism is on the way out as far as a governing body.

The bear was poked one too many times. The pandemic and now inflation were the pokes that did globalism in. There are now alternatives. Crypto instead of fiat and dollar tree toaster pastries instead of donuts.

It matters where the printed money goes as to what becomes inflated. If the printed money goes into stocks (QE 2008-2019) the stock market becomes inflated. If the printed money goes into businesses (Lockdown 2020-2021) the price of doing business becomes inflated. If the printed money goes into energy (2022) then the energy price becomes inflated which has a domino effect on anything that uses energy.

Seems like whoever counts the votes wins.

Sounds like what the Federal Reserve does.

That’s hardly anything to a bloated company like that. They are probably just firing the nice people that didn’t fit their culture anyway.

Isn’t that the point?

Bailouts are for banks. No banks. No need for bailouts. Self custody. We the people.

Bitcoin is like gold. You don’t pay for stuff in gold, that’s what kaspa is for.

It makes more sense for Satoshi Nakamoto to advertise for bitcoin than Tom Brady, just like it makes more sense for Tom Brady to quarterback in a Super Bowl than Satoshi Nakamoto.

Did the Wall Street Journal change the name of Twitter from Twitter to Elon Musk’s Twitter?

What industry? Bitcoin is a peer-to-peer electronic cash system.

Twitter is a software program. It runs itself.

Transparency may not help if you’re trying to cheat.

Bitcoin is like the wind, you can’t see it, but it’s there, just look at the flag (hardware wallet and addresses).

Bitcoin is not like gold in that you can paper it over confident most people won’t take possession.

Show me the bitcoin addresses.

If Grayscales bitcoin is paper they don’t understand bitcoin.

The Fed laundering money through a crypto bank would not be a good look.

It might take a while but eventually an energy producing country may say, “Why should we sell you this oil when you’re just printing money to pay for it? However, we will accept bitcoin.”

Recession denial does not mean we’re not in a recession. We have been for a while now.

Energy and labor shortages are not stopped by rate increases.

Issue KAS in place of fiat and then price energy and wages in KAS and then with the fixed supply of KAS inflation can be held in place.

That would mean the Fed better start to get its supply of KAS before it’s gone.

Energy companies and businesses might just have to do it themselves.

What if an energy company bought large amounts of KAS and then required payment for their energy in KAS?

They could benefit by getting paid in a currency (KAS) that cannot be debased plus benefit from an increase in the value of the KAS that they hold.

You don’t have to cash it out if you use it as cash.

“Abortion is the greatest war and greatest horror of all time.” Maria Simma speaks with Nicky Eltz (Authorized by Maria Simma) in the book “GET US OUT OF HERE!!” Maria Simma responds to this call from the Poor Souls in Purgatory.

Won’t that just increase inflation?

So where did the University of California get $4 billion to give to Blackstone? Might be time for an audit.

So how do you just locate more than $5 billion in cash and assets? Stealth QE.

I wonder how long it will be before that name gets changed?

A modern day bank run.

Pope Benedict XVI knew.

So how do they balance the budget? Money printer go Brrrrrr.

Simply flooded the system with money.

The energy budget must be balanced. So how does changing numbers on a screen or printing money out of thin air balance the energy budget?

Spotify is a software program. It runs itself.

So how is it free delivery if there is a fee? Maybe they should call it fee delivery.

So those of us who buy groceries, gasoline, and lumber have been in our own recession for over a year.

Nostr is new so not sure what to make of this.

Genesis 1:27 - God created mankind in his image; in the image of God he created them; male and female he created them.

Mark 8:34-38 - Jesus summoned the crowd with his disciples and said to them, "Whoever wishes to come after me must deny himself, take up his cross, and follow me. For whoever wishes to save his life will lose it, but whoever loses his life for my sake and that of the Gospel will save it. What profit is there for one to gain the whole world and forfeit his life? What could one give in exchange for his life? Whoever is ashamed of me and of my words in this faithless and sinful generation, the Son of Man will be ashamed of when he comes in his Father's glory with the holy angels."

Customers most likely will be spending money the back half of the year as well.

customer definition: 1. a person who buys goods or a service:

So I guess making it so workers want to quit is technically not a layoff.

So if the reference point for stablecoins is the dollar then there is no such thing as a stablecoin.

Seems there is an increasing number of people who are collecting bitcoin with little or no intention to sell. If you are thinking of buying a lot of bitcoin it could be much harder than you think.

Luke 11:29 - While still more people gathered in the crowd, Jesus said to them, "This generation is an evil generation; it seeks a sign, but no sign will be given it, except the sign of Jonah."

As a great Christian writer (George MacDonald) pointed out, every father is pleased at the baby's first attempt to walk: no father would be satisfied with anything less than a firm, free, manly walk in a grown-up son. In the same way, he said, "God is easy to please, but hard to satisfy."

Mere Christianity Book IV Chapter 9 - C.S. Lewis

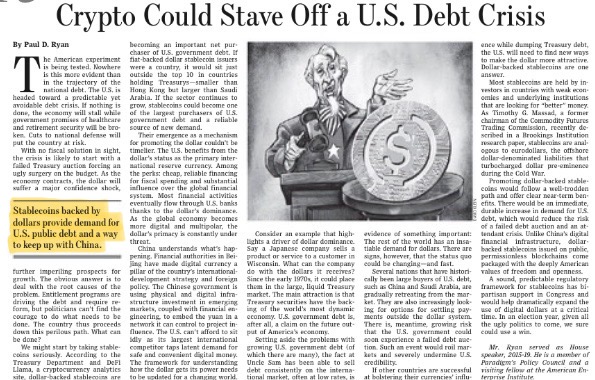

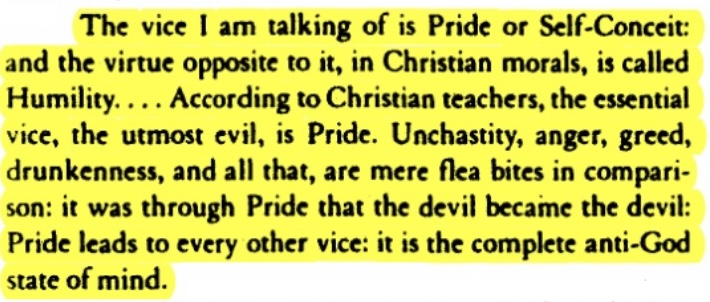

“The vice I am talking of is Pride or Self-Conceit: and the virtue opposite to it, in Christian morals, is called Humility. . . . According to Christian teachers, the essential vice, the utmost evil, is Pride. Unchastity, anger, greed, drunkenness, and all that, are mere flea bites in comparison: it was through Pride that the devil became the devil: Pride leads to every other vice: it is the complete anti-God state of mind.”

Mere Christianity Book III Chapter 8 - C.S. Lewis

Can't China just print money too? Might as well be 7,200%. What's the point of this? Fearmongering?

This just seems so weird to me.

Energy and labor shortages are not stopped by bank failures.

Makes it tough when an unrealized loss becomes a realized loss. When banks are forced to sell Treasuries at a loss to cover withdrawals when they don’t have the cash to begin with would pretty much crash every bank.

Energy and labor shortages are not stopped by bank bailouts.

It’s very possible that energy and labor shortages are actually made worse by bank bailouts.

Cheap energy leads to shortages and expensive energy leads to inflation. Take your pick. There is only so much oil.

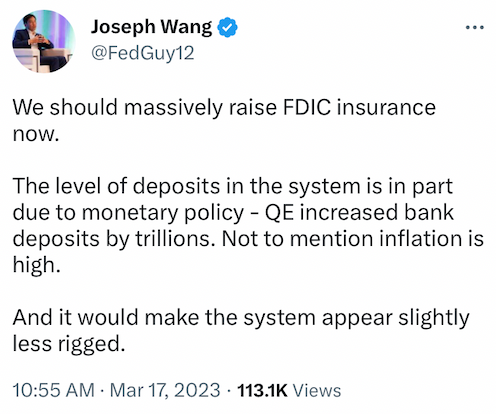

Making the system appear slightly less rigged is still a rigged system.

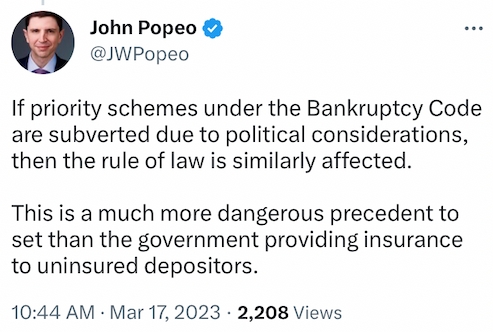

So does that mean that if you don’t like how the game is going you just change the rules?

So it appears that a bank run can still happen in these modern mobile banking days with tech savvy customers.

Does that look like a guy who just bought his rival?

Everybody gets a trophy!

Where's all the nickel?

That's as good as nickel, sir.

Those are rocks.

Mud wrestle Battle Royale.

How is this even allowed?

So when is this going to be addressed.

Maybe the same time this will.

The closest thing to a money printer that the average citizen has is a credit card.

Leading by example. Like country like citizen.

You don’t need the media to tell you what’s going on.

Governments like money they can print. Citizens like money that holds its value. Currently that’s not the same money.

As an anti-viral agent for the herpes virus family, the author found that EPA (Omega 3 fish oil, Eicosa Pentaenoic Acid, C20:5 omega 3), at doses between 180 mg. and 350 mg (depending upon body weight) 4 times a day for 2 to 6 weeks, without prescribing the common anti-viral agent Acyclovir, often eliminated the symptoms due to viral infection including all well-known types of the herpes virus, such as herpes simplex virus, Epstein-Barr virus, and cytomegalovirus. https://pubmed.ncbi.nlm.nih.gov/1973580/

Epstein-Barr virus and cytomegalovirus are usually not associated with intractable severe pain, but they are often associated with a recurrent burning or itching sensation and they can cause intractable frequent muscle twitching. Viruses belonging to the herpes family almost always exist between the midline of one side of the spinal cord and the midline of the front of the body where these nerves from the spinal cord end and the same virus is localized only on one side of the body at the same spinal level. https://pubmed.ncbi.nlm.nih.gov/1973580/

So do they need time to adjust to tip the scales in their favor?

Aren't stablecoins backed by fiat? Does that mean to imply that fiat is not a high-quality liquid asset?

It may be that people are realizing that banks are backed by banks and Treasuries are backed by Treasuries and they are all backed by a printing machine that by its use renders the system worth less. Bitcoin is not part of that system.

Isaiah 55:8-9 - My thoughts are not your thoughts, my ways not your ways—it is the Lord who speaks. Yes, the heavens are as high above earth as my ways are above your ways, my thoughts above your thoughts.

So someone probably starts with a Capital F and it's not First Republic.

So take your pick either high inflation or an expensive place to live.

If the Federal Reserve actually printed $1 Trillion on sheets of paper that contained 16 $100 bills each second nonstop it would take them 19.80 years. Maybe that’s why they just change numbers on a screen.

The Fed guaranteeing bank deposits with fiat doesn’t seem to be working. Maybe they should be guaranteeing bank deposits with bitcoin.

You don’t have to cash it out if you use it as cash.

Backed by bitcoin might change the negotiations.

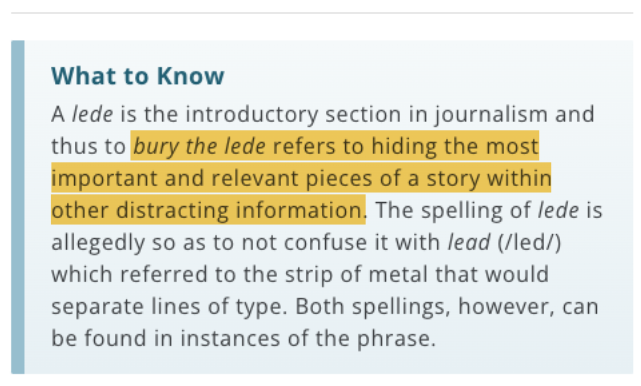

Hiding the most important and relevant pieces of a story within other distracting information seems par for the course these days.

Banning bitcoin would be like banning baseball cards. They both hold a value and are scarce and can be traded or stored.

"But it's not cash, cash."

What's so hard about bitcoin being an alternative attractive reserve asset?

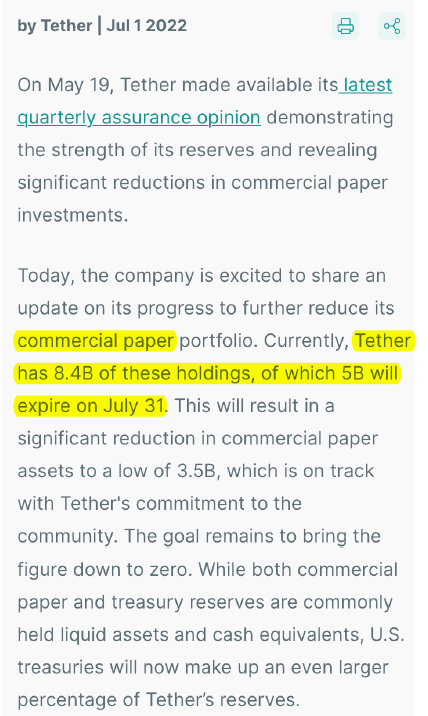

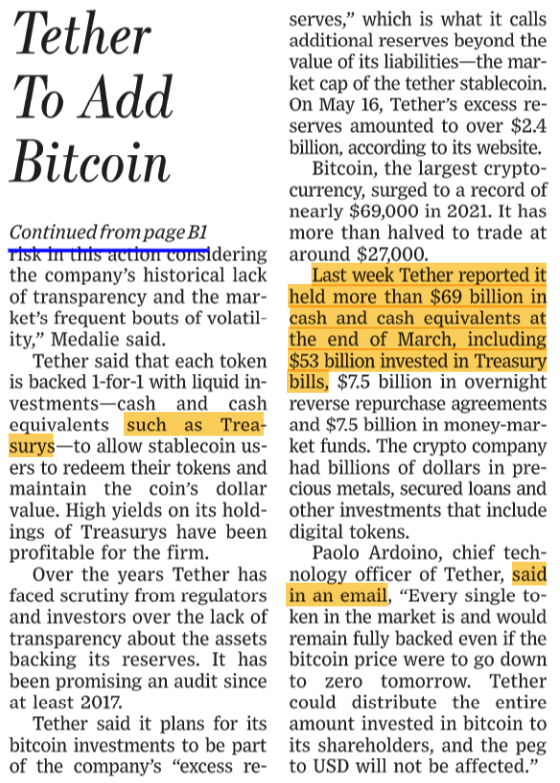

Who did Tether pledge to?

Tether claims.

So, if this is true, the US Government is helping to finance these bitcoin purchases. Nice.

So how does a space vehicle crash in mid-air?

To quote Nick Szabo. "Trusted third parties are security holes."

Either markets are rigged or another sketchy exchange is pulling some shenanigans. Who would sell enough bitcoin in 1 hour to have the price drop $1,400 from $26,800 to $25,400? Why would you sell bitcoin unless you had to.

Maria Simma knew.

Governments need compliance to function. Forced compliance is not compliance.

Can't be too secret if it's on the front page of the Wall Street Journal.

I guess it's ok to publish highly classified intelligence on the front page of the Wall Street Journal. Just don't store it in a shower.

If there is a climate crisis it’s caused by printing money. The energy budget must be balanced.

So are these 95 ton and 74 ton excavators electric?

It’s just easier for the Fed to do stealth QE on a few of the big boys.

When will central banks understand that what makes a digital currency valuable is the limited supply? If a CBDC is not limited it is no different than a $ symbol on a screen and they already have that.

When will other countries figure out that in a currency war the country with the most dollars wins and they don’t have the dollar printing press?

Many countries don’t like each other and certainly don’t trust each other. The only solution to that is a neutral reserve currency that is trustless with a limited supply. No 3rd party. They won’t want to use it but will be forced to because of the trust issue.

When the bidding wars on the limited supply proof of work digital currencies start and the countries crank up their home spun currency printing presses to compete for the limited supplies is when things will get interesting.

Bitcoin will need to be purchased to buy the other proof of work digital currencies because no miners will want to sell for fiat currencies.

The problem might be whether to sell the bitcoin you bought to buy other proof of work coins when the price of bitcoin will be increasing. But so will the price of the other proof of work coins. A free and fair market is one that not many countries have experience with.

If you charge too much for stuff that people can make at home. They'll just make it at home.

I tried to send $1 worth of bitcoin using the lightning network and the reply was "This request's amount is too low. Please try a bigger amount." Then I tried to send $1 worth of kaspa and it was received in less than 5 seconds and confirmed in a 10 seconds and had a fee of $0.00001689.

How does Kroger know if a shopper is affluent? Maybe because they have raised their prices so much they figure the only people who can still afford to shop there have to be affluent.

It's the other way around. Climate change is due to inflation and inflation is due to printing money.

Who decides who the expert is? Ignore the spectacle.

Prices can’t go up if there’s no more money to pay for them. Stop printing money or use a money that is hard capped like bitcoin or kaspa.

One problem with centrally controlled systems is they are slow to react. By the time the urgent issues reach central command it’s too late. Throwing money at a bankrupt company that is no longer in business doesn’t help.

They’ve got it all wrong. You don’t trade crypto. You buy it and then use it as money. Apparently they don’t know that crypto is short for cryptocurrency.

Wow that was fast. Look at the online version of the same story. I guess they didn't like the trajectory of their narrative push.

Interesting comment from the exiting CDC Head. Usually that is a comment made about bitcoin not about vaccines and health related matters.

Centralized fireworks displays cancel due to weather concerns whereas decentralized fireworks displays carry on as usual.

Movement of money is underrated. Which actually and physically moves faster, gold, dollars, bitcoin, or kaspa?

You don’t have to cash it out if you use it as cash.

Two words, bailouts and backstop.

A decrease in an increase is still an increase.

So, how does the saying go? "Don't mess with Mother Nature."

Anything that replaces discipline is probably not good.

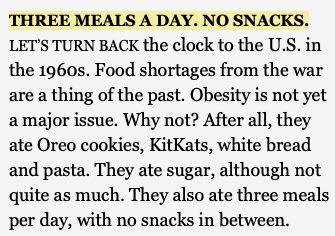

An excerpt from the Obesity Code.

Just substitute "printing money" for "climate change".

Maybe there might be some demand when it takes 5 minutes to charge and there are as many charging stations as gas stations. This is not rocket science.

If markets were free and not tampered with maybe they would be sending the right message.

It's all about control. Why aren't they asking who controls bitcoin? Maybe because the Fed thinks they do.

Not sure they understand what makes for a good real-world money.

Like what would happen to any bank if they don't get a bailout or backstopped.

While bitcoin was down over 10% kaspa was up over 10%. There is no paper kaspa.

This seems underrated.

So does that mean we have to save the fossil fuels for the military?

Either that or for huge RV’s towing ATVs.

Just substitute "printing money" for "new investors".

Isaiah 18:4,7

Luke 8:16-18

If it comes down to oil for crypto. It most likely would be a crypto that can't be bought with printed money.

So is robot just interchangeable with vehicles and machines?

Until an energy producing country says "we will sell oil and gas only for crypto" it will be monkey business as usual.

So if a bitcoin spot ETF gets approved and the big investments firms like BlackRock and Fidelity buy bitcoin for their investors and store it on Coinbase, then it will taken out of circulation and therefore not be able to be used as money. You know that, right?

Sirach 15:14-17

When God, in the beginning, created man, he made him subject to his own free choice. If you choose you can keep the commandments; it is loyalty to do his will. There are set before you fire and water; to whichever you choose, stretch forth your hand. Before man are life and death, whichever he chooses shall be given him.

So printing money and putting it into the stock market worked pretty good until boomers reached the age where they had to start withdrawing it. Now the printed money is showing up as inflation.

Here's another way of saying it.

So 2% on top of 40% is a soft landing?

Stealth QE?

So who is responsible if an AI bot does something?

“He was always like one who could not give an account of His views and actions to them, because they did not understand Him. In His instructions to them He was always more desirous of discovering to them their own thoughts and, on account of their earthly mindedness, of arousing in them distrust of self than of informing them of the reasons of things that they could not comprehend.”

The Complete Visions of Anne Catherine Emmerich (Illustrated) by Catherine Anne Emmerich & Catholic Book Club (editors)

If you can print money does price really matter?

If countries get involved they won’t want paper bitcoin.

The Big Bank of Kaspa.

You don’t have to cash it out if you use it as cash.

A third bet would be to get some bitcoin.

So will the price of metals go up as soon as we stop using them as money or we stop using them as metals?

So what happens when people start hyperventilating more and trees and crops don’t grow like they use to?

It’s starting to sound like these bitcoin ETFs will be a big nothing burger. If you want bitcoin just buy it yourself and download it to a hardware wallet.

Fees are making bitcoin unusable as a peer-to-peer electronic cash system. Time for kaspa.

The US struggles to spy on China, so just put it on the front page of the Wall Street Journal, maybe that will help. How ridiculous is that?

Why would any country take its own currency in payment when they can just print that currency anyway. There is no value in that.

The only currency that is going to have value is one that can’t be printed by any country.

Proof of work cryptocurrency. Energy for energy.

Oil for proof of work crypto.

Bitcoin is 15 years old.

So who buys the paper bitcoin when someone wants to cash out their bitcoin ETF? The next investor? Is that how a ponzi works? Cash in. Cash out. Where is the bitcoin?

I don’t read the Wall Street Journal for the truth but the narrative.

Like was stated earlier, unless bitcoin becomes the reserve currency, when the dollar price of bitcoin goes down it is just an indication of how much trouble the fiat system is in.

So is OTC bitcoin code for paper bitcoin?

So if bitcoin is the most liquid cryptocurrency does that mean that it is also controlled the most by the fiat system?

You don’t have to cash it out if you use it as cash.

Unless bitcoin becomes the reserve currency, when the dollar price of bitcoin goes up it is just an indication of how much trouble the fiat system is in.

It’s just easier for the Fed since they have the money printer.

Why would it take so long?

So is Tether a Fed printing machine proxy?

Everytime you wash, rinse, and repeat, colors fade and fibers unravel and materials degrade.

The Fed is trapped.

The levers are maxed.

The Fed is trapped. The levers are maxed. There is still some room left on the bitcoin and kaspa lifeboats.

I think it should read “Walmart Sales Ease as Prices Rise”.

Maria Simma knew. “The World Bank, the United Nations, the European Union and the International Red Cross are also synchronized with all of this and, despite all appearances, are NOT working for the benefit of the world.”

Maybe they will lower the price of milk, eggs, and bread.

The quants may want to change their bitcoin and bitcoin ETF algorithms to not sell no matter what the increase, unless they just want to buy back in higher.

Three days after a huge bitcoin pump and still not a word from the Wall Street Journal.

It seems as if the bitcoin ETF’s are actually buying bitcoin. Not papering it over. Maybe because they actually want it.

So if everyone bought the same stock the price would keep going up until some people decided to sell to get money to spend on other things. But if everyone bought the same money (bitcoin) the price would keep going up and there would be no reason to sell because you already have money (bitcoin). If the way of buying is through an ETF then cashing out may include using the cash to buy the actual bitcoin.

Sneaking in an ATH then a look out below suggests some shenanigans.

“Abortion is the greatest war and greatest horror of all time.” Maria Simma speaks with Nicky Eltz (Authorized by Maria Simma) in the book “GET US OUT OF HERE!!” Maria Simma responds to this call from the Poor Souls in Purgatory.

Wall Street Journal May 9, 2011.

Seems like a whale just gave BlackRock a nice discount. Limit orders filled, thank you very much.

Pretty tough to rely on charts in uncharted territory.

It is becoming more and more apparent that college is pricing itself out of usefulness.

There is a wonderful, almost mystical, law of nature that says three of the things we want most-happiness, freedom, and peace of mind-are always attained when we give them to others. -John Wooden

Printing and spending money like it’s going out of style. Maybe they are just trying to placate the citizens or is it really going out of style?

When longs get wiped out and then some shorts increase as a result it may be that the same money is playing both sides to drive down price.

It seems like the Fed is fine with the national debt increasing with higher interest rates because that’s just a built in excuse to print more money.

So they mean credit card payments?

When I was younger I was told that the smell of a feed lot was the smell of money. I wonder if the sound of bitcoin mining will become to be thought of as the sound of money.

Kaspa mining is not as loud as bitcoin mining.

So Grayscale is selling their bitcoin to BlackRock for a discount?

It could be only the noobs and the computer algorithms that are selling. Might be time for some reprogramming.

Is the Fed fighting off a bitcoin short? They do have a money printer at their disposal, but it’s operated at the expense of causing more inflation however.

Interesting how the WSJ doesn't fix a misplaced comma even in the online version.

If profit is measured in fiat there’s a good chance it may not be a profit.

So maybe they could buy bitcoin with all that cash.

At first they are conservative, they invest "what they can afford to lose". After 12-18 months, their small stash of bitcoins has dramatically increased in value. They see no reason why this long term trend should reverse: the fundamentals have improved and yet adoption remains low. Their confidence increases. They buy more bitcoins. They rationalize: "well, it's only [1-5%] of my investments". They see the price crash a few times, due to bubbles bursting or just garden-variety panic sales – it entices them to buy more, "a bargain". Bitcoin grows on the asset side of their balance sheet. - Pierre Rochard

So is the Fed performing delta neutral trades to try and control the price of bitcoin? Longing and shorting at a proportional amount that counterbalances each other to be net-zero. Money isn’t the issue. They can print as much as they want but they need to preserve the system that allows their printer to work.

So is it the cost or the price that you pay that matters?

Jesus answered them and said, “Amen, amen, I say to you, you are looking for me not because you saw signs but because you ate the loaves and were filled. Do not work for food that perishes but for the food that endures for eternal life, which the Son of Man will give you. For on him the Father, God, has set his seal.” So they said to him, “What can we do to accomplish the works of God?” Jesus answered and said to them, “This is the work of God, that you believe in the one he sent.” -John 26-29

There is no value in accepting money for payment that you can also print.

As long as the fiat printers are operational and they increase the supply by more than 1% per year the price of bitcoin in fiat terms will have to go up unless math changes.

I sent enough Digibyte to cover the cost of a coffee and you know how much the fee was? It was zero cents. You know how quickly it transferred? It took 1 second to send and 5 seconds to be received and had 4 confirmations in about a minute. Why wouldn’t a merchant accept Digibyte? No 2% merchant fee with Digibyte.

Now if you invoke as Father him who judges impartially according to each one’s works, conduct yourselves with reverence during the time of your sojourning, realizing that you were ransomed from your futile conduct, handed on by your ancestors, not with perishable things like silver or gold but with the precious blood of Christ as of a spotless unblemished lamb. He was known before the foundation of the world but revealed in the final time for you, who through him believe in God who raised him from the dead and gave him glory, so that your faith and hope are in God. -Peter 1 17-21.

Just because rates are up does not mean the Fed is not printing money.

All countries are printing money and pretending that the others are not. What a charade.

So was the bond market designed to keep people from questioning the fiat system?

Markets can be predictable especially when you know what the Fed is going to buy or sell.

The modern day piggy bank is a Kaspa wallet.

It seems as if only some of the bitcoin ETF’s are actually buying bitcoin. This could get very interesting.

People can make coffee and burritos at home cheaper than if they buy them from Starbucks or Chipotle. But they can’t make bitcoin at home cheaper than they can buy it, even at today’s prices.

Bitcoin ETF’s that are not buying bitcoin must have a lot of confidence that they will be backstopped when the ponzi collapses. Where’s all the bitcoin? That’s as good as bitcoin, sir. Those are IOU’s.

Paper bitcoin is fake bitcoin.

When nation states with money printers start buying bitcoin it’s best not to sell.

Bitcoin is like an interpreter for different fiat currencies.

Sounds like climate change.

Come now, you rich, weep and wail over your impending miseries. Your wealth has rotted away, your clothes have become moth-eaten, your gold and silver have corroded, and that corrosion will be a testimony against you; it will devour your flesh like a fire. You have stored up treasure for the last days. Behold, the wages you withheld from the workers who harvested your fields are crying aloud; and the cries of the harvesters have reached the ears of the Lord of hosts. You have lived on earth in luxury and pleasure; you have fattened your hearts for the day of slaughter. You have condemned; you have murdered the righteous one; he offers you no resistance. -James 5:1-6

“That desire and resolve created an atmosphere which attracted the forces necessary to the attainment of the purpose. Many of these young men will tell us that, as long as they were hoping and striving and longing, mountains of difficulty rose before them; but that when they fashioned their hopes into fixed purposes aid came unsought to help them on the way.” -Orison Swett Marden, An Iron Will

So how many bitcoins is that? The article doesn’t say, or maybe BlackRock just hopes that someone buys their ETF the same day someone else wants to cash out.

Could it be going from actual bitcoin held to paper bitcoin?

I think they are called voters who actually got their vote to count.

There is no bitcoin without bitcoin miners.

There is gold without gold miners.

Could it be that market makers are actually money printers?

It seems as if money printers were invented for bailouts.

It’s what allows Tether to still exist. You buy our stuff you can still be a stablecoin.

Dollar backed just means the Fed is buying its own stuff.

Printing billions of dollars to short bitcoin to control the price will make already bad inflation worse.

It makes no sense to sell a currency that has a limit to debasement (bitcoin) for one that does not (fiat).

My guess is it’s not so much lending money as it is just giving money. The banks know they will be backstopped.

I sent enough Kaspa to cover the cost of a coffee and you know how much the fee was? It was zero cents. You know how quickly it transferred? It took 5 seconds to send and 1 second to be received and 10 seconds to be credited to the wallet. Why wouldn’t a merchant accept Kaspa? No 2% merchant fee with Kaspa.

Take away the money printer.

Why can’t they just light a torch and say “let the games begin”?

As much as I like bitcoin it’s looking like kaspa may actually do a better job of being a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution quicker.

Someone might want to tell Amazon that USPS has access to the money printer.

Brothers and sisters: I, a prisoner for the Lord, urge you to live in a manner worthy of the call you have received, with all humility and gentleness, with patience, bearing with one another through love, striving to preserve the unity of the spirit through the bond of peace: one body and one Spirit, as you were also called to the one hope of your call; one Lord, one faith, one baptism; one God and Father of all, who is over all and through all and in all. Eph 4:1-6

If the US government buys 1,000,000 bitcoin and then wants to use it to get out of debt then currently that would put each bitcoin worth around $35,000,000.

Can bitcoin serve as a lie detector? It’s starting to look that way.

Seems like they are trying to make the elephant become the room.

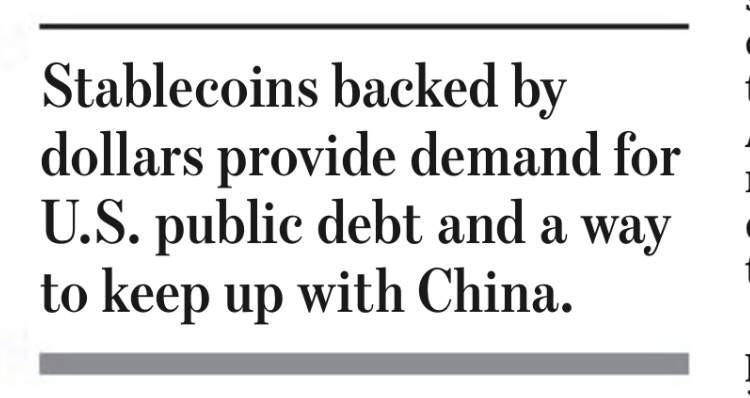

Might have added fewer jobs?

C. S. Lewis

It’s pretty tough to run a business without customers unless you are just given printed money by the government. But wouldn’t that encourage a business that wasn’t wanted and also contribute to inflation?

Bitcoin should have a price of over $90,000 at this point in its algorithm when you take into account inflation.

Kaspa is a better peer-to-peer electronic cash system than bitcoin. What happens when this becomes known?

In the debate the old abortion arguments reared their ugly head again. 1. You don’t base policy on rare exceptions (for example rape and incest). Otherwise no laws would ever be passed. 2. It’s not the woman's body. It’s the baby’s body. If it was the woman’s body she would be the one who dies in an abortion.

Paper gold vs real bitcoin.

Seems like if you are intent on building a reliable cancer business it takes away the incentive of eradicating cancer.

What could a knucklehead do for a job that would be ok?

If you’re running for President and you hire a knucklehead to be your Vice President, what does that say about the person running for President?

A knucklehead bagging groceries would put canned goods on top of the bread and bananas.

Still we must never, never worry, for all fear is only from Satan. If we try conscientiously to live with God every day, He will protect us from whatever it is that lies ahead. Praying people will be safe but those not praying will be caught off guard and be unprotected. It is that simple; and we must trust in God and His Mother with the trust of small children. -Maria Simma

What happens when a digital wallet is trusted more than paper money?

Why don’t they just buy bitcoin instead of cash? Their stock price might actually go up.

Seems like supply chains are just another type of chain.

When will Jane Street realize they should just buy and hold bitcoin instead of selling even if the Fed has given them a blank check?

Good response.

It was interesting when I went to Freddy’s tonight. There was a different vibe in the restaurant. It was like the workers were glad to be there and were taking pride in their job.

Holiday doesn’t have magic but Christmas does.

Have no anxiety at all, but in everything, by prayer and petition, with thanksgiving, make your requests known to God. Then the peace of God that surpasses all understanding will guard your hearts and minds in Christ Jesus. Philippians 6-7

If the DOJ is doing their job they might be surprised who is actually doing the money laundering.

When you have a money printer does the price of bitcoin even matter?

They can’t let the price of gold run because the price of fillings and jewelry would become too expensive and contribute to inflation. So it’s going to have to be bitcoin.

Might be time to sell gold and buy bitcoin.

Instead, there shall always be rejoicing and happiness in what I create; For I create Jerusalem to be a joy and its people to be a delight; I will rejoice in Jerusalem and exult in my people. No longer shall the sound of weeping be heard there, or the sound of crying. -Isaiah 65:18-19

If you look at bitcoin like buying property it’s still a very good deal. Plus there’s no upkeep or property taxes or insurance.

Seems like quantum computing FUD should be directed as much or more so at the traditional banking system than bitcoin.

If it’s cheaper to buy bitcoin than to mine it these days what does that say about the value of fiat?

Printing fiat money and stuffing it into the bitcoin bag may help but what really needs to happen is going to an unprintable money that has the capacity to handle the volume of transactions with low fees (Kaspa).

It may be that the only way to keep up with inflation is to buy bitcoin or get paid in bitcoin.

Inflation is the problem and it seems another wave is coming.

The only way to halt inflation is to stop printing money.

Bitcoin in 2024: +121% Bitcoin's return nearly tripled the best hedge fund's return in 2024.

Inflation ruins the fiat currency Ponzi scheme.

Inflation is a default.